Residential Rents Accelerating in US, Fastest Pace in 21 Months

26/03/2018

Residential News » Seattle Edition | By Michael Gerrity | March 26, 2018

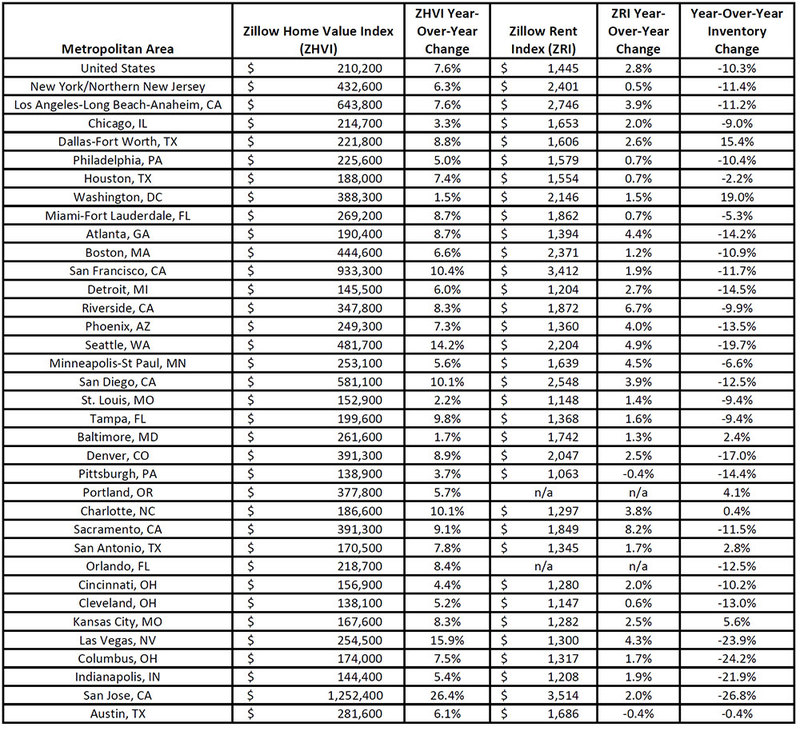

According to the February 2018 Zillow Real Estate Market Report, residential median rent across the nation is accelerating at its fastest pace in 21 months. Over the past year, the median rent in the U.S. rose 2.8 percent to a Zillow Rent Index (ZRI) of $1,445.

The fastest appreciating rental markets are along the West Coast in Sacramento, Calif., Riverside, Calif., and Seattle. This is the seventh month in a row that Sacramento has topped the list of markets with the fastest rental growth. Median rent in Sacramento rose more than 8 percent since last February to a ZRI of $1,849.

Fast FAQs:

- U.S. median rent rose 2.8 percent over the past year, to $1,445. This is the fastest pace of rental appreciation since May 2016.

- Rent is rising the fastest in Sacramento, Calif., Riverside, Calif., Seattle and Minneapolis.

- Home values across the U.S. rose 7.6 percent since last February, to a median of $210,200. San Jose, Calif., Las Vegas and Seattle reported the greatest home value growth over the past year.

- Going into home shopping season, buyers will have 10 percent fewer homes to choose from than a year ago.

- Mortgage rates at the end of February were the highest since April 3, 2014.

Minneapolis and Atlanta also are among the fastest-appreciating rental markets, both reporting about a 4.5 appreciation rate over the past year.

As for-sale inventory remains tight, home prices rise and higher mortgage rates erode affordability, more households may opt to rent rather than buy -- either by necessity or by choice -- driving up demand for rental homes.

"Rental appreciation slowed between 2015 and mid-2017, but is once again picking up steam, reaccelerating over the past nine months," said Zillow senior economist Aaron Terrazas. "For-sale inventory is tight, and with home prices continuing their rapid climb, it's becoming more and more difficult for renters to become owners, forcing them to rent longer than they otherwise would have. Searching for the 'right' home has become a drawn out affair and rising prices require more savings for a down payment. Were it not for strong new apartment construction over the past half-decade, rental appreciation would be even stronger than it is now."

Over the past nine months, national home value growth has fluctuated in the range of 7.2 percent to 7.6 percent annually. For the year ending in February 2018, home values rose 7.6 percent to a median of $210,200.

San Jose, Calif., Las Vegas and Seattle reported the greatest home value growth over the past year. In San Jose, home values rose more than 26 percent since last February to a median of $1,252,400. In Las Vegas, the median home value rose almost 16 percent; in Seattle, the median home value rose 14 percent.

Going into home shopping season, buyers will have 10 percent fewer homes to choose from than a year ago, with San Jose, Columbus, Ohio and Las Vegas reporting the greatest drop in inventory. In San Jose, there are almost 27 percent fewer homes on the market than last year, and 24 percent fewer in Columbus and Las Vegas.

The end of February saw mortgage rates at their highest since April 3, 2014. Mortgage rates on Zillow increased throughout February, starting at 4.06 percent, the lowest rate of the month, and ending at 4.26 percent. The high was hit mid-month, at 4.28 percent. Zillow's real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Mortgages site and reflect the most recent changes in the market.