Residential News »Irvine Edition | By Michael Gerrity | July 19, 2019.

Homeowners enjoy a $ 9.7 trillion gain in equity in last 10 years, up from $ 6.1 trillion in Q1 of 2009.

According to a special report by CoreLogic titled "The Role of Housing in the Longest Economic Expansion" - which analyzes the US housing market's impact on the latest 121-month economic expansion from June 2009 through July 2019 - states that US employment rates typically They have a positive impact on the housing economy and they can lead to an increase in the likelihood of having a home equity business.

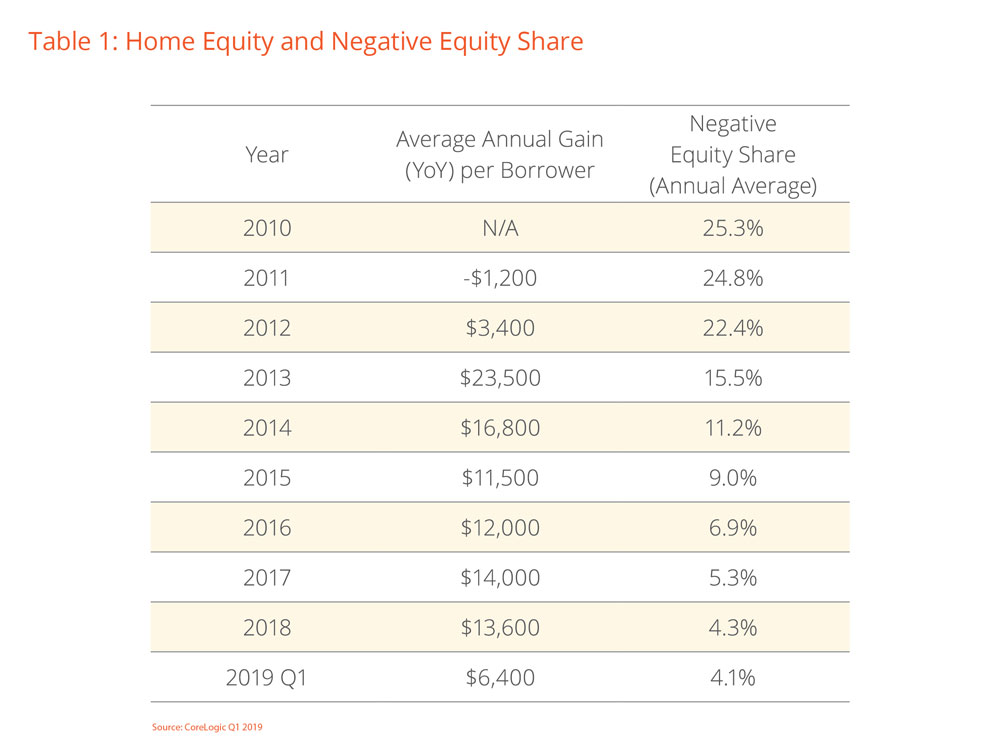

In the first quarter of 2010, 25.9% of the total number of mortgages in the United States were negative in equity. As the market has been improved over the past decade, this share dropped to 4.1% in the first quarter of 2019 (Table 1). A strong economy and an increase in total home equity helped to reduce the negative equity share. Total home equity reached a record of $ 15.8 trillion at the end of the first quarter of 2019, up from $ 6.1 trillion in the first quarter of 2009.

Key Data Trends

The percent of homes with negative equity went from 25.9% in the first quarter of 2010 to 4.1% in the first quarter of 2019.

Total home equity hit a record of $ 15.8 trillion at the end of the first quarter of 2019, up from $ 6.1 trillion in the first quarter of 2009. Between the first quarter of 2010 and the first quarter of 2019, the average equity per borrower increased from approximately $ 75,000 to approximately $ 171,000.

Since 2010, the flip rate has greatly increased. In the first quarter of 2018, the number of properties bought and sold within a two-year period reached its highest point at 11.4%.

Since June 2009, homepage and rents have continued to grow. Through May 2019, a 50% increase in the cumulative and 50% in the United States.

"During the last nine years, the expansion has created more than 20 million jobs," said Frank Nothaft, chief economist at CoreLogic. "The longest stretches of home equity insurance have resulted in these factors."

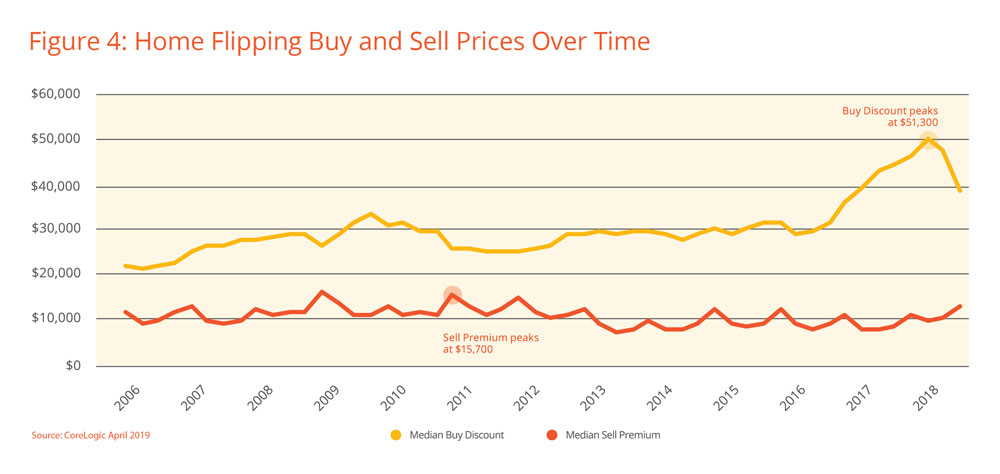

Housing has long been associated with wealth creation in the United States. Home flipping, or the act of buying a property for profit, is a tactic that some homeowners use to generate profit. Since the last recession, the flipping rate has increased significantly: the two-year flip rate reached its highest point in the first quarter of 2018 at 11.4%, up from its lowest level (4.9%) in the third quarter of 2010. (Figure 4)

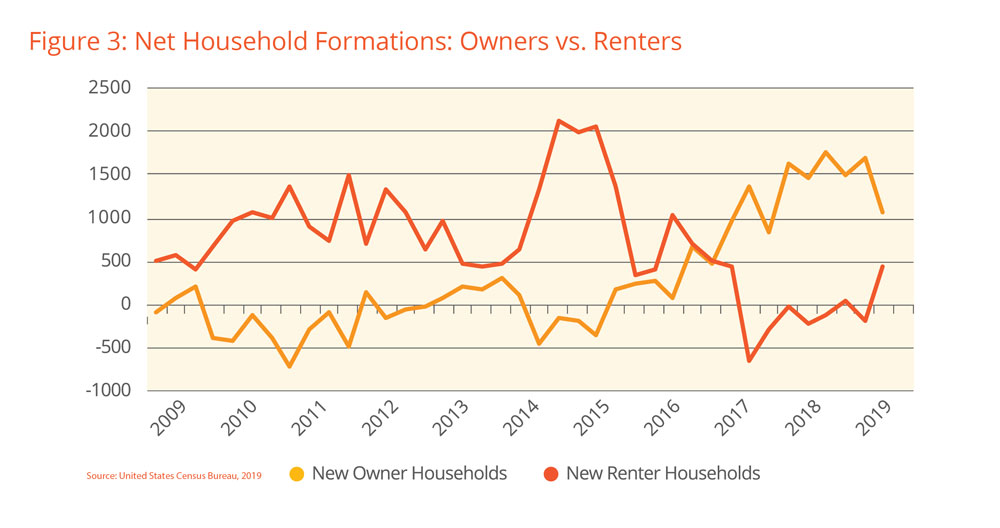

Home prices have begun to decline, but are still declining. However, from June 2009 through May 2019, they have continued to grow. Through May 2019, a 50% increase in the cumulative and 50% in the United States. In the first quarter of 2019, 1.1 million new homes joined the housing economy, while the number of renters increased by 458,000. (Figure 3)

With increasing recession, many first-time homeownership, choosing to rent for longer. However, in 2018, the largest cohort for home purchases, accounting for 44% of home-purchase mortgage applications. These millennial buyers are looking for affordability and not buying in the typical coastal cities seen in the past.

According to CoreLogic Market Condition Indicators (MCI), in May 2019, four of the top 10 metros for millennial buyers were undervalued (Pittsburgh, Rochester, NY; Wichita, Kansas and Grand Rapids, MI), five metros were at value (Buffalo , New York, Milwaukee, Albany, New York, Provo, Utah and Des Moines, Iowa) and one metro was overvalued (Salt Lake City). Metros in California had the lowest percentage of millennials applying for a mortgage.

Despite an unemployment rate near a 50-year low, inflation rates below the Federal Reserve Board's 2% target and strong GDP growth (3.1%) in the first quarter of 2019, concerns of a looming recession have been rising. The report explores recent recession indicators and looks at how the economy could weather the next dip.